It's not Magic. It's Modernization

The origin of Customer Relationship Management (CRM) software dates to 1987, when the first customer data-base software called ACT! was introduced. This early version of CRM software stored customer details and sales history, making it easier to search and organize data. From these simple beginnings, CRM has grown to be the largest software market in the world. In fact, the CRM market is expected to reach more than $80 billion in revenues by 2025.

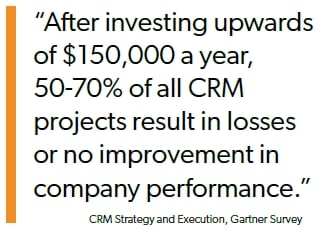

Like other industries in which customer relationships are key to sales growth, the banking industry has adopted CRM software. Now, many of today’s banking services, such as online banking, couldn’t function without it. Yet, despite having invested significant budgets into their CRM systems, many banks and credit unions find their CRM investments aren’t quite living up to expectations.

Does that mean the software doesn’t work? Absolutely not. It’s just that CRM systems are only as good as the information stored in them. If your customer representatives aren’t documenting each customer conversation in the CRM, you will likely miss many revenue-generating opportunities.